Bank code

This article depends generally or altogether on a solitary source. Important conversation might be found on the discussion page. If it's not too much trouble help improve this article by acquainting references with extra sources.

Discover sources: "Bank code" – news ·newspapers · books · researcher · JSTOR(December 2008)

A bank code is a code appointed by a national bank, a bank administrative body or a Bankers Association in a nation to all its authorized part banks or money related foundations. The standards shift generally between the nations. Likewise the name of bank codes changes. In certain nations the bank codes can be seen over the web, yet generally in the nearby language.

The (public) bank codes contrast from the worldwide Bank Identifier Code (BIC/ISO 9362, a standardized code - otherwise called Business Identifier Code, Bank International Code and SWIFT code). Those nations which utilize International Bank Account Numbers (IBAN) have generally incorporated the bank code into the prefix of indicating IBAN account numbers. The bank codes additionally contrast from the Bank card code (CSC).

The expression "bank code" is in some cases (improperly) utilized by dealers to allude to the Card Security Code imprinted on a Mastercard.

Europe

Belgium has a public framework with account quantities of 12 digits. There are no different bank codes. The initial 3 digits of the record number are known as the convention number, and demonstrate the bank the record has a place with.

Czech Republic and Slovakia have 4-digit bank codes, utilized behind record number (household account number is XXXXXX-YYYYYYYYYY/CCCC, where CCCC is bank code). A bank office can be distinguished from the bank code.

Denmark has 4-digit bank code (called Registreringsnummer, or Reg. nr.).

France has a 10 digit code, the initial 5 digits contain the freeing identifier from the financial organization (Code Banque), trailed by the 5-digit branch (Code Guichet). The two numbers are just utilized as a joined prefix for the cross country full record number.

Germany has a 8-digit directing code. The initial 4 digits distinguish the financial organization and the last 4 digits are doled out to the branch. In the 4-digit bank identifier:

the principal digit relates to one of 8 freeing locales from Germany,

the initial 3 digits (clearing locale identifier and the following 2 digits after it) distinguish a "banking area" (Bankplatz),

the last digit (fourth in the entire steering code) means a financial organization's order (Bankengruppe).

For bank characterization esteems and identifiers for German clearing districts, see Bankleitzahl (in German).

For an extensive rundown of Germany's "banking area" identifiers, see Bankplätze (in German).

Greece has a 7-digit Ηellenic Bank Identification Code (HEBIC), where the initial 3 digits are the bank code and the last 4 the branch code.

Ireland utilizes a 6-digit sort code followed by a 8-digit account number like and mostly coordinated with the UK framework.

The initial two digits of the sort code recognize the bank (90-xx-xx = [Bank of Ireland], 98-xx-xx = [Ulster Bank], for instance) and the last 4 distinguish the branch.

There is a special case with 99-xx-xx - these codes are utilized for worldwide banks Irish Clearing ACs, and some Post Office accounts.

Italy has a comparable clearing framework is utilized with 5 digits distinguishing the financial organization (Codice ABI), trailed by a 5-digit CAB (Codice di Avviamento Bancario) recognizing the branch, trailed by the record number.

The Netherlands has a public framework with account quantities of 9 or 10 digits. There are no different bank codes. The initial 5 digits of the record number can be utilized to distinguish the bank (initially likewise the branch, yet customers can now regularly keep their record number when they move to another branch).

Spain additionally has a comparative organization, with the initial 4 digits recognizing the financial organization, the following 4 distinguishing the branch, the following 2 being the checksum, trailed by the 10-digit account number.

Switzerland has a 3 to 5 digit bank code (Bankenclearing-Nummer); the main digit demonstrates the bank's arrangement gathering. Trailing the bank code, a 4-digit number branch code identifier. For a rundown of Swiss bank codes, see Bank clearing number.

Sweden has 4 digit bank codes (clearingnummer), with an additional check digit for Swedbank. The first or two digits are the bank gathering, and the rest the branch. For a rundown of Swedish bank codes, see lista över clearingnummer till svenska broker (in Swedish).

Ukraine has 6 digit bank codes. Record number does exclude bank code. Rundown of bank codes is accessible at the site of the National Bank of Ukraine.[1]

The UK has a 6-digit sort code. For prefixes distinguishing UK banking organizations, see the rundown of sort codes of the United Kingdom.

As of February 2014 all nations in the Single Euro Payments Area have changed to an IBAN-based framework for clearing (counting TARGET2 for cross-outskirt moves). The public bank codes have been incorporated into the IBAN definition, by and large toward the beginning of the new record number (beginning at position 5 after the basic prefix of two-letter nation identifier and two check digits). This is substantial for moves in the euro money. Nations which hold their own cash utilize their own framework for moves in their money.

North America

US - The American Bankers Association since 1910 has utilized a 9-digit steering travel number to distinguish American banks, which are utilized in the robotized handling of checks. The bank organization is distinguished in the fifth to eighth digits (the 4 digits before the last checksum digit). The organization number doled out to a bank incorporates a provincial prefix showing the metropolitan zone or potentially state.

Canada utilizes codes called steering numbers.[2] They comprise of 5 digits recognizing the branch and the 3 digits distinguishing the money related foundation.

South America

Venezuela - The Central Bank of Venezuela, since 2001, has utilized a 20-digit to recognize venezuelan banks. The bank organization is recognized in initial four digits followed by four digits for office, two digits for checksum and last ten digits for bank account.[3]

Argentina - In this nation each financial balance is recognized by the CBU (Clave Bancaria Uniforme).It is a 22-digit code develop as follows: 3 digits for the Bank Code, 4 digits for the Agency, 1 check digit and 13 digit for the ledger.

Asia-Pacific

Australia has a 6-digit Bank State Branch (BSB) code which goes before the record number. The initial 2 or 3 digits demonstrate the monetary organization and the other 3 or 4 digits are the branch codes alloted by the establishment.

New Zealand has a 6-digit prefix indistinguishable from Australia's BSB code, and in spite of the fact that they seem comparable (for example ANZ financial balances in the two nations start with 01, Westpac with 03), they are not viable. The initial 2 digits demonstrate the bank and the following 4 digits show the branch. All digits, alongside the seven-digit account number and a few digit postfix, are required for all wire moves whether or not the exchange is intra-bank or interbank.

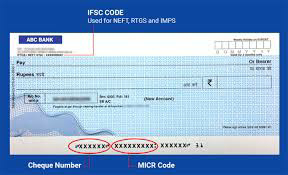

India has a 11-digit alpha numeric Indian Financial System Code (IFSC). The initial 4 characters show the budgetary organization, the fifth digit is 0 and the other 6 digits demonstrate the branch. In the middle of room you simply enter 0 in it to finish.

Iraq has a 1 to 3 digit bank code which distinguishes the bank office.

Indonesia It is utilized for clearing/kliring exchanges, for example, checks, giros, and so forth. PayPal utilizes this local clearing code to move cash from the PayPal records of Indonesian clients to their Indonesian financial balances in Rupiah. The initial three digits of the bank code are likewise utilized for between bank moves utilizing an ATM.

Since 2010, South Korea utilizes a 7-digit code beginning with 0 or 2. The initial 3 digits, called the bank code, is required for interbank wire moves. The last 4 digits are a branch code, which is infrequently utilized.

Comments

Post a Comment